The Rising Three Methods is a bullish continuation candlestick pattern that occurs during an uptrend. It consists of five candles and signals a brief pause or consolidation within the prevailing uptrend, after which the price is expected to continue moving higher. This pattern indicates that while there is some temporary selling pressure, the overall bullish trend is still intact and the market is likely to resume its upward movement.

1. Characteristics of the Rising Three Methods Pattern:

The Rising Three Methods pattern is composed of five candlesticks, with specific characteristics that identify it as a continuation signal:

- First Candle (Strong Bullish Candle):

- The first candlestick is a long bullish candle (green/white), indicating that buyers are in control and the market is trending higher.

- Next Three Candles (Consolidation or Correction):

- The next three candles are generally small-bodied candles, either bullish or bearish (but typically not as long as the first candle).

- These three candles represent a temporary consolidation or correction, where the price moves sideways or slightly lower, but the market does not reverse.

- The bodies of these candles should be contained within the body of the first candlestick (i.e., they should not break above the high of the first candle or below its low significantly).

- Fifth Candle (Strong Bullish Candle):

- The fifth candle is another long bullish candle that closes above the high of the first candle, confirming that the uptrend is resuming.

2. How to Identify the Rising Three Methods Pattern:

To identify the Rising Three Methods, look for the following conditions:

- Uptrend Preceding the Pattern:

- The pattern forms after a strong uptrend or significant bullish price action. It signals a temporary consolidation or a pullback before the trend continues higher.

- First Candle:

- A long bullish candle (green or white) marks the start of the pattern, indicating the strength of the uptrend.

- Three Consolidation Candles:

- The next three candles should be small-bodied and confined within the range of the first candle (i.e., their highs and lows should be inside the range of the first candle).

- These candles may be either bullish or bearish, but their size should be small compared to the first candle, indicating that the price is consolidating or undergoing minor retracement.

- Fifth Candle:

- The fifth candle should be a long bullish candle that closes above the high of the first candle. This confirms that the uptrend is resuming, and the consolidation phase is over.

3. Interpretation of the Rising Three Methods Pattern:

The Rising Three Methods pattern indicates that the bullish trend is likely to continue after a period of consolidation. Here’s why:

- Temporary Pullback:

- The small-bodied candles in the middle of the pattern represent a temporary pause or retracement in the market. While sellers may have momentarily gained some control, they were not strong enough to reverse the trend.

- Market Reaffirms Strength:

- After the brief consolidation, the price resumes its upward movement with the fifth candle, confirming that the bulls are still in control and the overall trend remains intact.

- Indicates Continuation:

- The pattern is a bullish continuation signal, suggesting that the previous upward momentum will continue once the consolidation phase is over.

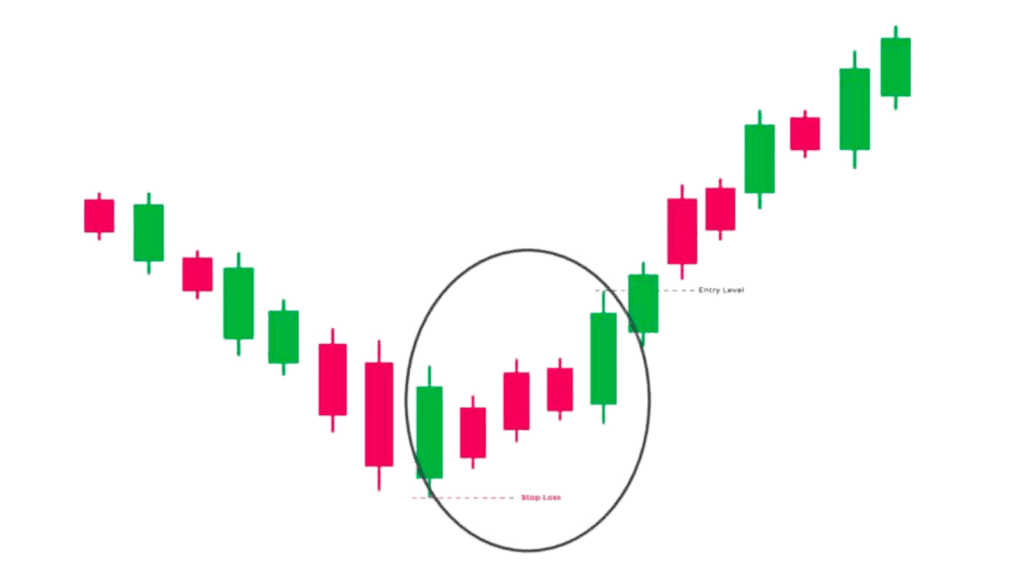

4. How to Trade the Rising Three Methods Pattern:

Entry:

- A common entry point is to buy once the fifth candle closes above the high of the first candle in the pattern. This shows that the bulls have regained control and the uptrend is resuming.

- Some traders prefer to wait for a small pullback after the fifth candle or a retest of the breakout point before entering.

Stop-Loss:

- A typical stop-loss is placed below the low of the third candle, where the consolidation or pullback took place. If the price falls below this level, it suggests that the bullish trend may be reversing.

- Alternatively, you could place the stop-loss just below the low of the fifth candle, though this would give the trade a bit more room to fluctuate.

Profit Target:

- Resistance levels: The profit target can be set at nearby resistance levels, such as previous highs, trendlines, or Fibonacci retracement levels.

- Alternatively, traders may use a risk-to-reward ratio (e.g., 2:1 or 3:1) to determine a profit target based on the distance from the entry point to the stop-loss.

5. Confirmation and Additional Indicators:

Confirmation is important to ensure the pattern is a valid continuation signal:

- Volume:

- The volume during the Rising Three Methods pattern is crucial for confirming the pattern’s validity. Ideally, the volume should increase during the first and fifth candles, showing that the buying pressure is strong.

- During the three consolidation candles, volume might decrease or stay neutral, reflecting the market’s indecision during the pause.

- Follow-up Candles:

- After the completion of the pattern, look for follow-up bullish candles to confirm that the uptrend is indeed continuing. A strong move above the high of the fifth candle can further increase the reliability of the signal.

- Momentum Indicators:

- RSI (Relative Strength Index): If the RSI is not in overbought territory (typically above 70) when the pattern completes, it confirms that the trend can continue. A slight pullback or reset of the RSI below 70 before the pattern completes can also add to the bullish confirmation.

- MACD (Moving Average Convergence Divergence): A bullish MACD crossover or a rising MACD histogram after the pattern completes is a strong confirmation that the bullish trend will continue.

- Moving Averages: If the price is above key moving averages (e.g., 50-day or 200-day), it further supports the idea that the uptrend is likely to continue after the consolidation phase.

6. Example of the Rising Three Methods Pattern:

Let’s say the price of a stock is in an uptrend:

- Candle 1 (Bullish): The stock opens at $50 and closes at $60, forming a strong green candlestick.

- Candles 2, 3, and 4 (Consolidation): The stock moves sideways for three days, with the following candles:

- Candle 2: Opens at $58, closes at $56.

- Candle 3: Opens at $56, closes at $57.

- Candle 4: Opens at $57, closes at $58.

- These candles have small bodies, and their highs and lows remain within the range of the first candle’s body.

- Candle 5 (Bullish): The stock opens at $58 and closes at $63, above the high of the first candle ($60).

In this case, a trader may enter a long position after the fifth candle closes at $63, as this confirms that the uptrend is likely to continue. A stop-loss could be placed below $56 (the low of the third candle), and the profit target could be set at a previous resistance level or a fixed risk-to-reward ratio.

7. Limitations of the Rising Three Methods Pattern:

- False Signals:

- Like any candlestick pattern, the Rising Three Methods can occasionally produce false signals if the overall market conditions are not favorable for a continuation or if the consolidation phase is too long. It’s important to wait for confirmation before entering a trade.

- Market Context:

- The pattern is most effective when it forms in the context of a strong uptrend. If the market is in a sideways or weak uptrend, the pattern may not be as reliable as a continuation signal.

- Volume Issues:

- A lack of increased volume on the fifth candle or low volume during the consolidation phase could reduce the reliability of the pattern. In such cases, the pattern may fail to result in a strong continuation.

8. Rising Three Methods vs. Falling Three Methods:

- The Rising Three Methods is a bullish continuation pattern that occurs during an uptrend, while the Falling Three Methods is a bearish continuation pattern that occurs during a downtrend.

- In the Falling Three Methods, the price consolidates temporarily in a downtrend, after which the price resumes its downward movement with a long bearish candle.

Both patterns share similar structures, but one is used to anticipate upward price movement (Rising Three Methods) and the other downward price movement (Falling Three Methods).

9. Key Takeaways:

- The Rising Three Methods is a bullish continuation pattern that occurs during an uptrend and signals a temporary consolidation before the trend resumes.

- It consists of five candlesticks: a long bullish candle, three small candles (bullish or bearish), and a final long bullish candle that closes above the high of the first candle.

- The pattern is more reliable when there is confirmation in the form of increased volume, bullish follow-up candles, and support from momentum indicators.