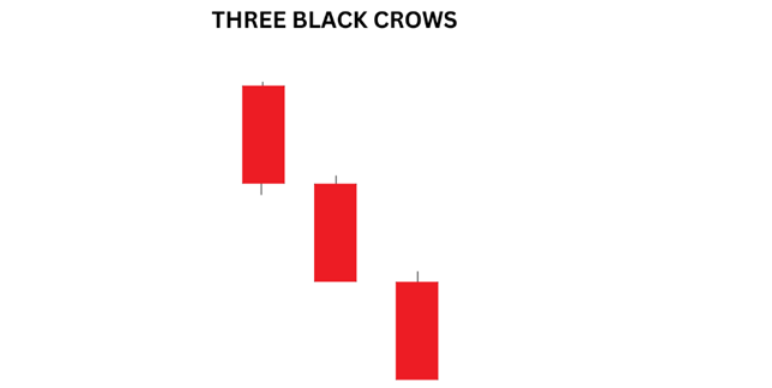

The Three Black Crows is a bearish candlestick pattern that signals a strong reversal from an uptrend to a potential downtrend. It is considered a powerful and reliable signal of a trend reversal, especially when it forms after a prolonged uptrend. The pattern consists of three consecutive long bearish candles that close lower than the previous day, indicating that the bears are in control and the bulls are losing strength.

Key Features of the Three Black Crows Pattern:

- Three Consecutive Bearish Candles:

- The pattern consists of three long bearish candles (typically red or black), each closing lower than the previous day’s close.

- Each of the three candles should ideally have a real body that is longer than the previous one, showing an increasing dominance of sellers.

- Open Within or Near the Previous Candle:

- Each bearish candle opens near or slightly within the body of the previous candle, suggesting that there is a sustained downtrend. This creates a “crawling” pattern where each candle follows through from the previous day’s bearish sentiment.

- Downward Momentum:

- The pattern should show increasing selling pressure, with each successive candle closing lower than the previous one. The longer the bodies of the candles, the stronger the reversal signal.

- No Gaps:

- Unlike some other candlestick patterns, the Three Black Crows pattern doesn’t require the candles to gap lower. The lack of gaps is one of the distinguishing characteristics that separates it from other bearish reversal patterns.

Characteristics of the Three Black Crows Pattern:

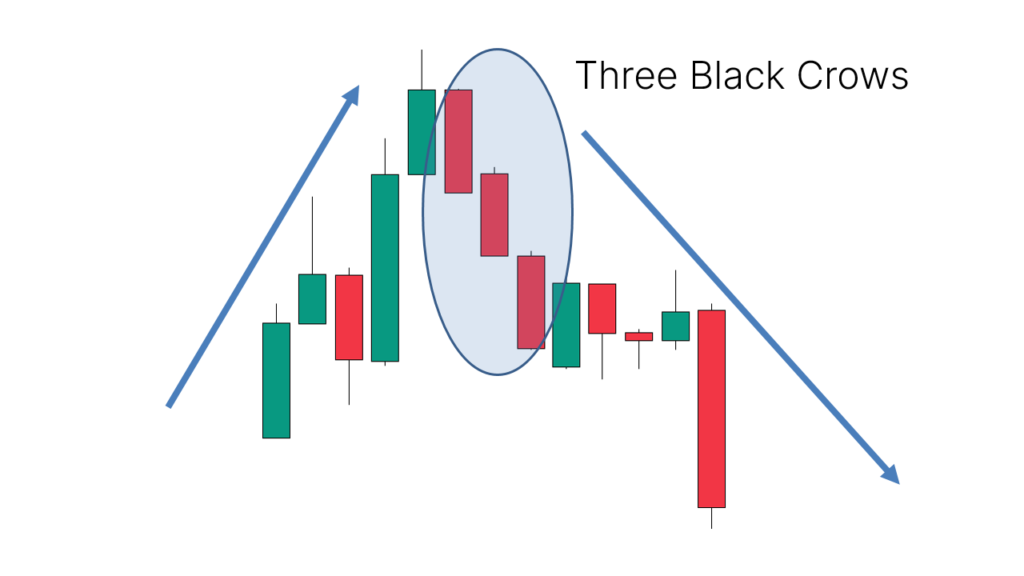

- Trend: The pattern forms after an uptrend and suggests that the price action is reversing, with the bears starting to overpower the bulls.

- Bearish Reversal: It is a bearish reversal pattern, indicating that the price may fall sharply after the pattern forms, as it shows the market has shifted from buying pressure to selling pressure.

Example of the Three Black Crows Pattern:

- Imagine a stock is in a strong uptrend, and then over three consecutive days, it forms three long red candles, each closing lower than the previous one. The third day’s close is much lower than the second, signaling a shift in momentum from bullish to bearish.

- The price fails to make a new high, and the bears begin to push the price significantly lower with each passing day.

Interpretation:

- Bearish Reversal Signal: The Three Black Crows pattern is a bearish reversal pattern that signals that the uptrend may be ending and a downtrend may begin. The fact that each of the three candles closes lower than the previous one suggests that the bears are gaining control and pushing the price lower.

- Increased Selling Pressure: The increasing size of the bearish candles signals increasing selling pressure and is often seen as a sign that the market sentiment has shifted.

- Loss of Bullish Momentum: After a prolonged uptrend, the formation of the Three Black Crows indicates that the bulls are losing momentum and the bears are taking over.

How to Use the Three Black Crows in Trading:

- Wait for Confirmation:

- The Three Black Crows pattern is more reliable when confirmed by a continuation of the downtrend in subsequent candles. Ideally, you want to see the price continue to fall after the third candle.

- Confirmation can come in the form of additional bearish candles or a break below key support levels.

- Volume:

- Higher volume during the formation of the three bearish candles strengthens the signal. If the candles form with relatively low volume, the pattern might not be as reliable.

- A high volume on the third candle, especially if it is much larger than the volume of the first two candles, adds credibility to the bearish reversal.

- Stop-Loss Placement:

- A common approach is to place a stop-loss order just above the high of the third candle (the last candle of the Three Black Crows). This ensures that if the price continues higher, the position will be closed before too much loss occurs.

- Support/Resistance Levels:

- The Three Black Crows pattern is more reliable when it appears near resistance levels or after an extended uptrend. If the pattern forms near a resistance area, it strengthens the likelihood of a bearish reversal.

Example of the Three Black Crows in Context:

- Uptrend: A stock has been rising steadily for several weeks.

- Three Black Crows: The stock then forms three consecutive long bearish candles, each closing lower than the previous one.

- Bearish Signal: This indicates that the buyers are losing control, and the sellers are starting to take over, potentially leading to a sharp decline in price.

- Confirmation: If the stock continues lower in the following days, this would confirm that the Three Black Crows pattern was a valid signal of a bearish reversal.

Important Notes:

- False Signals: The Three Black Crows pattern is not foolproof. If the third candle is followed by a strong reversal upward, the pattern could fail. Traders should always wait for confirmation and use additional indicators to strengthen their analysis.

- Time Frame: The pattern can appear on any time frame, but it is generally more reliable on higher time frames (such as daily or weekly charts) where trends are more established.

- Volatility: In highly volatile markets, the Three Black Crows pattern may form quickly and give false signals, especially if there’s significant intraday price movement.

Differences Between Three Black Crows and Other Bearish Patterns:

- Bearish Engulfing: The Bearish Engulfing pattern consists of two candles: a smaller bullish candle followed by a larger bearish candle that completely engulfs the first. In contrast, the Three Black Crows pattern involves three candles, each closing lower than the previous one, with no need for one candle to engulf the other.

- Dark Cloud Cover: The Dark Cloud Cover is a two-candle pattern where a bearish candle opens above the previous bullish candle and closes below its midpoint. The Three Black Crows involves three consecutive bearish candles and indicates stronger bearish momentum.

Summary:

The Three Black Crows is a bearish reversal candlestick pattern that consists of three consecutive long bearish candles, each closing lower than the previous one, forming after an uptrend. The pattern suggests that the bulls are losing momentum and that the bears may be taking control of the market, signaling a potential reversal or start of a downtrend. It is considered a strong bearish signal, but confirmation through subsequent price action and volume is crucial for increased reliability. Proper stop-loss placement, volume analysis, and support/resistance levels should also be considered to improve the accuracy of the signal.