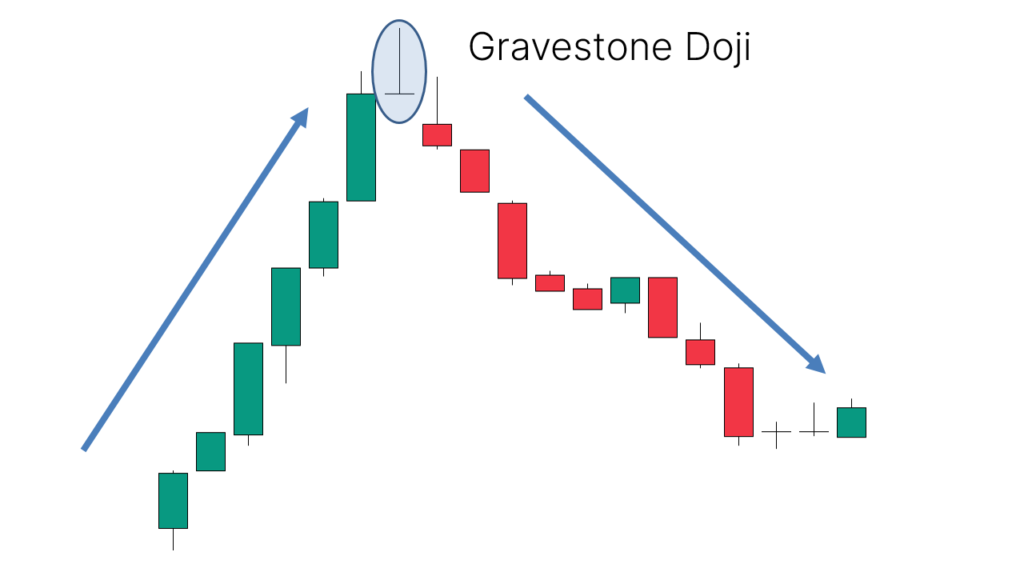

The Gravestone Doji is a bearish candlestick pattern that signals market indecision and often indicates the potential for a reversal to the downside, particularly after an uptrend. It is a type of Doji candlestick with a small body located near the low of the candlestick, with a long upper shadow and little to no lower shadow. The pattern suggests that buyers tried to push the price higher during the session, but sellers managed to regain control, causing the price to close near its opening level. This rejection of higher prices is a sign that the market might be ready to move lower.

Key Features of the Gravestone Doji:

- Small Body:

- The body of the Gravestone Doji is small, located near the low of the candlestick, indicating that the opening and closing prices are very close to each other. This small body reflects indecision or a stalemate between buyers and sellers during the session.

- Long Upper Shadow:

- The long upper shadow is the defining feature of the Gravestone Doji. It shows that buyers tried to push the price higher during the session, but sellers took control and forced the price back down, causing the candlestick to close near its opening price. The long upper shadow reflects the rejection of higher prices by the market.

- The upper shadow is typically at least twice the length of the body but can be much longer in some cases.

- No or Very Short Lower Shadow:

- The Gravestone Doji typically has little to no lower shadow, indicating that the price did not drop significantly during the session. This suggests that although there was some buying pressure, it was ultimately unable to sustain the price at higher levels.

How to Interpret the Gravestone Doji:

- Bearish Reversal Signal:

- The Gravestone Doji is generally considered a bearish reversal pattern, particularly when it forms after an uptrend. It signals that the bulls (buyers) were unable to maintain their control of the market and that the bears (sellers) have started to take charge.

- The long upper shadow indicates that the market tested higher prices, but sellers rejected those higher prices by the close, suggesting a shift in momentum from bullish to bearish.

- The small body near the bottom of the candlestick, combined with the long upper shadow, reflects that the session ended in a stalemate, with neither the bulls nor the bears able to decisively control the market at the close.

- Context Is Key:

- The significance of a Gravestone Doji depends heavily on where it appears in the market:

- After an uptrend: If the Gravestone Doji forms after a significant uptrend, it can signal that the uptrend is losing momentum and that a downtrend or price reversal could be imminent.

- Near resistance levels: If the pattern forms near a key resistance level, it is often seen as a rejection of higher prices and a potential precursor to a price drop.

- During strong rallies: If the pattern forms during an overbought condition or after an extended rally, it might indicate that the market is nearing exhaustion and could soon reverse.

- Confirmation of Bearish Reversal:

- Like many candlestick patterns, the Gravestone Doji is often considered a potential reversal signal rather than a definitive one. Confirmation from the next candlestick is critical to validate the pattern’s signal.

- If a bearish candlestick (such as a red or black candle that closes lower than the Gravestone Doji) forms after the pattern, it confirms the bearish reversal.

- If the next candlestick is bullish (a green candle), the Gravestone Doji may be a false signal, and the price may continue higher.

- Volume Considerations:

- The volume accompanying the Gravestone Doji can provide additional insight into the strength of the reversal signal. A Gravestone Doji with high volume could indicate a more significant shift in market sentiment, while one with low volume might suggest a weak or temporary rejection of higher prices.

- Volume increases during the formation of the pattern may suggest that the rejection of higher prices is more likely to be a precursor to a real reversal.

Trading Strategies with the Gravestone Doji:

- Reversal Signal After an Uptrend:

- If the Gravestone Doji forms after a strong uptrend, it can signal that buying momentum is waning and that a downtrend may follow. A trader might consider taking profits or opening a short position (selling) after the pattern.

- A stop-loss can be placed above the high of the Gravestone Doji’s upper shadow to protect against a breakout or continuation of the uptrend.

- Confirmation Candle:

- Wait for a confirmation candle after the Gravestone Doji, such as a bearish engulfing candle or a black candle that closes below the Gravestone Doji’s low. This would confirm the bearish reversal and provide more confidence in the trade.

- Enter a short position after the confirmation, targeting key support levels or recent lows.

- Risk Management:

- For a short trade, set a stop-loss just above the high of the Gravestone Doji’s upper shadow. This helps manage risk in case the price continues to rise.

- For a long trade, it is best to avoid entering unless there is clear confirmation of a reversal (e.g., a strong bullish candlestick after the Gravestone Doji).

- Volume-Based Confirmation:

- Traders might also pay attention to the volume accompanying the Gravestone Doji. If the candlestick forms with high volume, it suggests that there is stronger selling pressure and increases the likelihood of a successful bearish reversal.

- If volume is weak, the pattern may be less reliable, and traders should exercise caution.

Example of Gravestone Doji in Context:

- After an Uptrend:

- The price has been rising for several periods, and a Gravestone Doji forms at the top of the trend. The long upper shadow suggests that the bulls attempted to push prices higher but were unable to maintain that momentum. The small body at the low of the candlestick indicates that the price closed near the opening level.

- A trader might look for a bearish confirmation candle (e.g., a red candlestick) in the next period to confirm that the reversal is underway and to enter a short position.

- At Key Resistance:

- The price has been moving higher, and the Gravestone Doji forms near a significant resistance level, signaling that the market is rejecting higher prices. This could be a potential signal for a reversal, with the price moving lower from the resistance zone.

- A bearish confirmation candle after the Gravestone Doji would increase the probability of a successful short trade.

- Overbought Conditions:

- The market is in an overbought condition, with a strong rally, and a Gravestone Doji forms, signaling that the market has exhausted its buying momentum. This could be a sign that prices are about to reverse.

- Traders could look for a confirmation candle (such as a bearish candlestick) to signal that the price is likely to fall from the overbought zone.

Differences Between the Gravestone Doji and Other Doji Patterns:

- Gravestone Doji vs. Dragonfly Doji:

- The Dragonfly Doji has a long lower shadow and small body near the top, indicating that sellers pushed the price lower but were overpowered by buyers, signaling a potential bullish reversal.

- The Gravestone Doji, on the other hand, has a long upper shadow and small body near the low, signaling that buyers tried to push the price higher but were rejected by sellers, indicating a potential bearish reversal.

- Gravestone Doji vs. Standard Doji:

- A Standard Doji has a small body and equal length upper and lower shadows, reflecting indecision without any strong directional bias. The Gravestone Doji has a long upper shadow and little to no lower shadow, indicating that the market tried to move higher but ultimately rejected higher prices.

- The Gravestone Doji is more bearish and often seen as a potential reversal to the downside, while a Standard Doji is typically neutral and may require further context to interpret.

- Gravestone Doji vs. Hanging Man:

- The Hanging Man is similar to the Gravestone Doji in that both have a small body and long shadow, but the Hanging Man has a long lower shadow, indicating that sellers attempted to push the price lower but buyers eventually drove it back up.

- The Hanging Man typically appears after an uptrend and can signal a potential reversal to the downside, similar to the Gravestone Doji. However, the Hanging Man has a longer lower shadow, while the Gravestone Doji has a long upper shadow and little to no lower shadow.

Important Notes:

- False Signals: Like all candlestick patterns, the Gravestone Doji can sometimes be a false signal, especially if it occurs in low volatility markets or if it’s not confirmed by the following price action. Traders should always look for confirmation from subsequent candlesticks.

- **

Trend Continuation**: If the Gravestone Doji is followed by a strong *bullish* candlestick or if it occurs in the middle of an uptrend, it might not signal a reversal and could just be a momentary pause before the trend continues.

Summary:

The Gravestone Doji is a bearish candlestick pattern that appears after an uptrend and suggests that the buyers were unable to maintain control of the market, leading to a potential downtrend or price reversal. It is characterized by a small body near the low of the candlestick and a long upper shadow, reflecting the rejection of higher prices by the market. The Gravestone Doji is a bearish reversal pattern, but it requires confirmation from subsequent price action to validate its signal. When combined with other technical indicators or support/resistance levels, it can be a useful tool for traders looking to identify potential trend reversals.