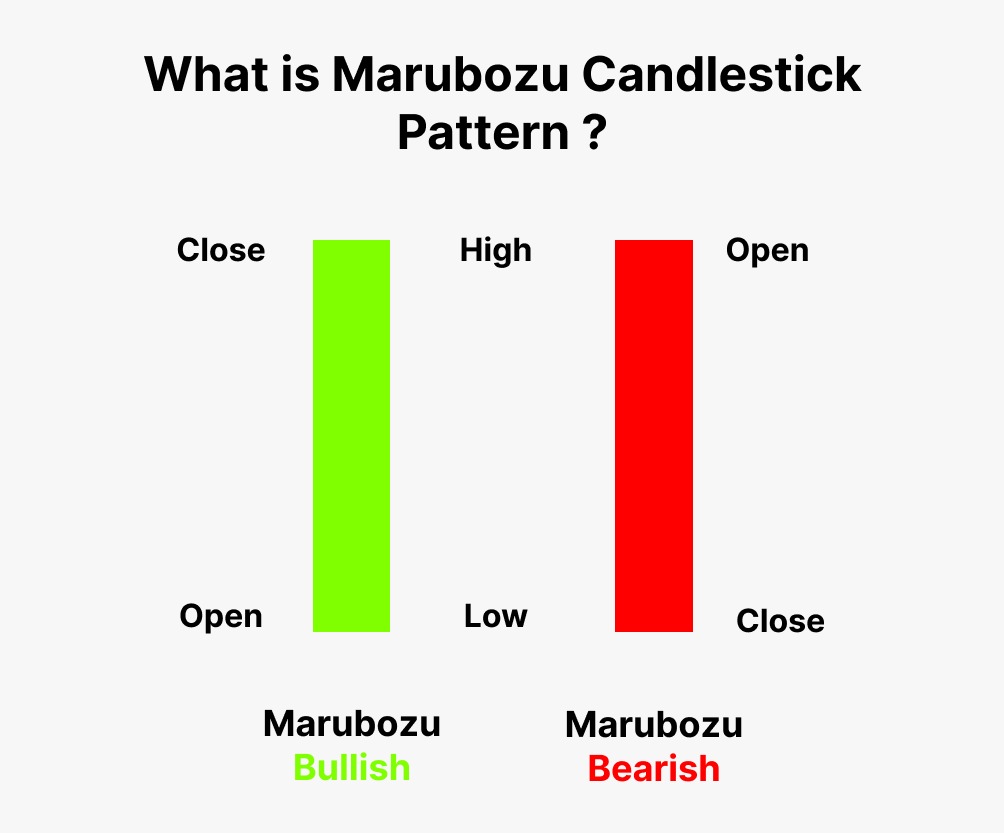

A Bearish Marubozu is a candlestick pattern that indicates strong selling pressure and is typically seen as a bearish signal. It is a single candle with no wicks or shadows (or very small shadows) at both the top and bottom, meaning the open and close prices are at the extremes of the candle. In a Bearish Marubozu, the body of the candlestick is entirely filled (usually red or black), indicating that the price moved lower throughout the session with no significant retracement.

Key Features of the Bearish Marubozu:

- Long Body:

- The candle has a long body, which means the difference between the open and close is large.

- The candle is entirely bearish (closed lower than it opened), meaning it’s usually red or black, indicating that the bears controlled the price movement from the open to the close.

- No or Very Small Shadows:

- A true Bearish Marubozu has no upper or lower shadows or very small shadows. The top of the body represents the opening price, and the bottom of the body represents the closing price.

- If there are small shadows, they are inconsequential to the interpretation of the pattern but still indicate a lack of retracement or reversal during the session.

- Close Lower Than Open:

- The price opens at the high of the session and closes at the low. This suggests strong selling pressure throughout the entire session, with the bears maintaining control the entire time.

Interpretation:

- Bearish Sentiment: The Bearish Marubozu indicates that selling pressure is strong, and the market was unable to recover or retrace higher during the trading session. This suggests that the sellers were in complete control.

- Trend Continuation or Reversal:

- After an uptrend: A Bearish Marubozu that forms after an uptrend signals that the uptrend may be ending, or at least that the market is due for a pullback or reversal.

- After a downtrend: It can indicate that the downtrend is likely to continue, with more selling pressure in the near future.

- Sign of Weakness for Bulls: The fact that the price opens and closes at the extremes suggests that the bulls were unable to generate any upward momentum, and the bears completely dominated the session.

How to Use the Bearish Marubozu in Trading:

- Confirmation:

- A single Bearish Marubozu is a strong bearish signal, but like all candlestick patterns, it is best to wait for confirmation. Confirmation can come in the form of additional bearish candles or a break below support levels following the formation of the Bearish Marubozu.

- If the next candle is also bearish, it increases the reliability of the pattern as a signal that the trend may be reversing or continuing downward.

- Volume:

- Higher volume during the formation of the Bearish Marubozu increases its reliability. High volume suggests that the bearish sentiment behind the move is strong and backed by substantial participation in the market.

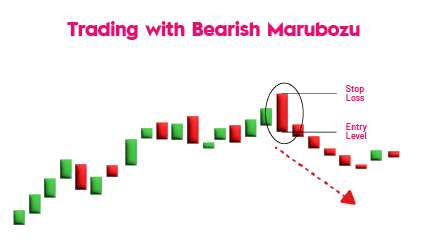

- Stop-Loss Placement:

- If you’re trading a short position based on a Bearish Marubozu, a common stop-loss strategy would be to place a stop above the high of the Marubozu candle (the open). This way, if the market reverses and the price rises, you can exit the trade quickly to minimize potential losses.

- Support and Resistance:

- The Bearish Marubozu is more significant when it forms at or near resistance levels after a period of upward movement, as it signals that the buyers may have been exhausted and that the bears are taking over.

- It is also important to consider other technical indicators and market structure (such as trendlines or moving averages) to confirm that the price is indeed at a key level for reversal or continuation.

Example of the Bearish Marubozu Pattern:

- Uptrend: A stock has been rising steadily for several days.

- Bearish Marubozu Forms: On the next day, the stock opens at $100 and immediately starts to fall, closing at $90. The candle has no wicks, showing that the price moved directly from the high to the low of the session with no retracement.

- Bearish Signal: The formation of the Bearish Marubozu suggests strong selling pressure and a potential reversal of the uptrend. Traders might consider looking for confirmation of further bearish movement before entering a short position.

Differences Between Bearish Marubozu and Other Bearish Patterns:

- Bearish Marubozu vs. Bearish Engulfing:

- A Bearish Engulfing pattern consists of two candles: a smaller bullish candle followed by a larger bearish candle that fully engulfs the body of the previous candle.

- A Bearish Marubozu, on the other hand, is a single candle that shows strong bearish sentiment with no retracement.

- The Bearish Marubozu is typically seen as a more decisive signal, as it reflects strong and uninterrupted bearish activity throughout the entire session.

- Bearish Marubozu vs. Dark Cloud Cover:

- A Dark Cloud Cover is a two-candle pattern where the second candle opens above the high of the first and closes below its midpoint, signaling a potential reversal.

- The Bearish Marubozu is a single candle with no shadows, indicating that the price opened at the high and closed at the low, suggesting continuous selling pressure during the session.

Important Notes:

- False Signals: Like all candlestick patterns, the Bearish Marubozu can sometimes produce false signals. If the market immediately reverses after forming a Marubozu, it could be a sign of market indecision or a false breakdown. Always look for confirmation before acting on a signal.

- Time Frame: The reliability of the Bearish Marubozu increases on higher time frames, such as daily or weekly charts. A Bearish Marubozu on a daily chart after an uptrend is generally more significant than one on a 5-minute chart.

- False at the Bottom: If a Marubozu forms after a downtrend (i.e., the price opens at the low and closes at the high), it is called a Bullish Marubozu and signals potential buying pressure and a reversal to the upside.

Summary:

A Bearish Marubozu is a strong bearish candlestick pattern that shows the price opened at the high and closed at the low of the session, with no or very small shadows. It indicates strong selling pressure and suggests that the bears are in control. This pattern is a bearish reversal signal when it appears after an uptrend, and it can signal the continuation of a downtrend when it forms after a down move. To improve its reliability, traders should wait for confirmation, consider volume, and use stop-loss orders to manage risk.