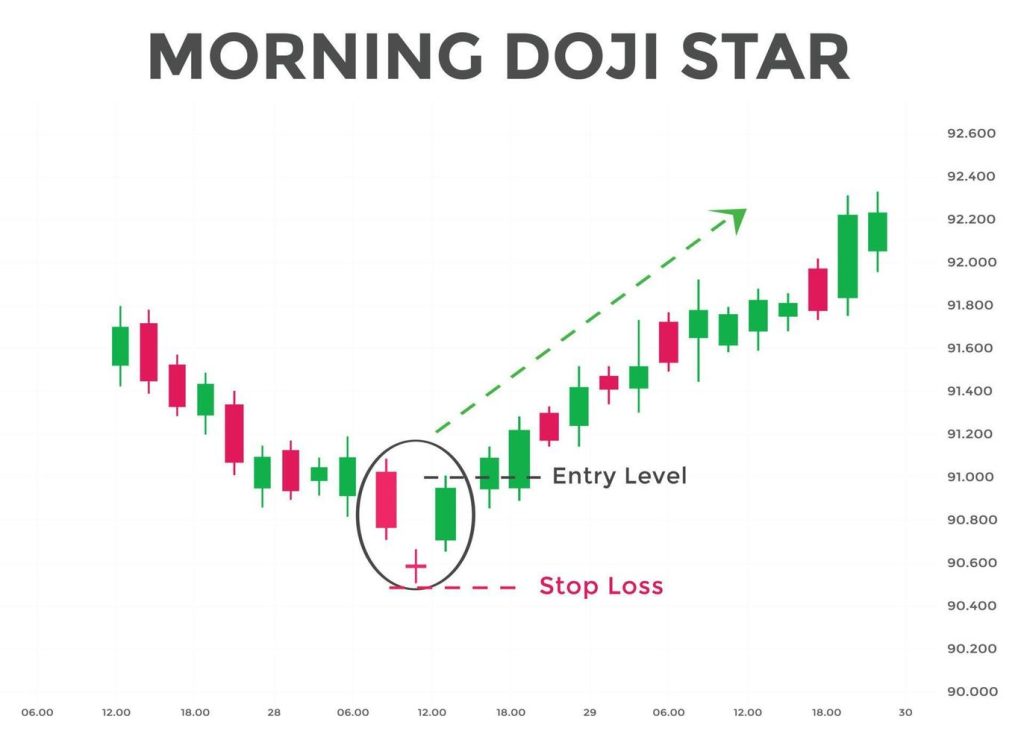

The Morning Doji Star is a bullish reversal candlestick pattern that typically forms after a downtrend and signals a potential reversal to the upside. It consists of three candles: a large bearish candlestick, followed by a Doji (which indicates indecision), and then a bullish candlestick that closes above the midpoint of the first bearish candlestick. This pattern suggests that sellers have lost momentum, and buyers are beginning to take control.

Key Features of the Morning Doji Star:

- First Candle – Bearish:

- The first candle is a large bearish candle, which indicates strong selling pressure and suggests that the market is in a downtrend.

- Second Candle – Doji:

- The second candle is a Doji, characterized by a small body and long shadows, indicating indecision in the market. The Doji shows that both buyers and sellers were active, but neither side could gain full control.

- Third Candle – Bullish:

- The third candle is a bullish candle that closes above the midpoint of the first bearish candle. This confirms that buyers have taken control and the market is likely to move higher.

How to Interpret the Morning Doji Star:

- Bullish Reversal After a Downtrend:

- The Morning Doji Star is considered a bullish reversal pattern, particularly when it appears after a downtrend. It signals that selling pressure has started to weaken and that buyers are starting to assert control, suggesting the potential for a price increase.

- Confirmation:

- The third candle, a bullish candle, is critical for confirmation. It must close above the midpoint of the first bearish candle to validate the reversal signal. If the third candle fails to close above the midpoint, the pattern may not be reliable.

- Location Matters:

- The pattern is most effective when it forms near support levels or after a prolonged downtrend. Its success rate is higher if it occurs after a significant price drop or at a point where the market has been in an oversold condition.

- Volume Considerations:

- Volume plays an important role in confirming the Morning Doji Star. Increasing volume during the third bullish candle can indicate strong buying interest and reinforce the potential for a trend reversal. Low volume might suggest weaker conviction and a less reliable signal.

Trading Strategy with the Morning Doji Star:

- Entry Point:

- Traders typically enter a long position after the third bullish candle closes above the midpoint of the first bearish candle. This confirms the shift in momentum from bearish to bullish.

- Stop-Loss:

- A stop-loss is often placed below the low of the Doji (second candle) to manage risk in case the pattern fails and the downtrend continues.

- Target:

- Profit targets can be set based on resistance levels or other technical indicators, such as a Fibonacci retracement level or recent highs.

Example of Morning Doji Star in Context:

- After a significant downtrend, a large bearish candle forms, followed by a Doji showing indecision, and then a bullish candle closes above the midpoint of the previous bearish candle. This suggests that the market is likely to reverse and move higher.

Summary:

The Morning Doji Star is a powerful bullish reversal pattern that forms after a downtrend. It consists of three candles: a large bearish candle, a Doji, and a bullish candle that confirms the reversal. The pattern suggests a shift in market sentiment from bearish to bullish, especially when combined with confirmation from volume or support levels. Traders often use it to enter long positions with the expectation of an upward move.