The Rising Three Methods (Bearish) is a bearish continuation pattern that occurs in an uptrend and signals that the price is likely to resume the current downtrend after a brief pause. Despite the “Rising” name, this pattern has a bearish implication. It typically forms in an extended uptrend and suggests that the market is consolidating before continuing downward. The pattern is a type of three-candle continuation formation, with a specific arrangement of bullish and bearish candles.

Key Features of the Rising Three Methods (Bearish) Pattern:

- Trend Context:

- The Rising Three Methods (Bearish) pattern forms during an uptrend. This is important because the pattern suggests that the price is about to reverse and continue the previous downtrend after a brief pause or consolidation.

- Five Candles:

- The pattern consists of five candles in total:

- The first candle is a long bullish candle that continues the existing uptrend.

- The next three candles are small-bodied bullish candles (often considered “sideways” or neutral candles), which consolidate within the range of the first bullish candle.

- The final candle is a long bearish candle that closes below the low of the first candle, signaling a return to bearish momentum.

- Bullish Consolidation:

- The three smaller candles within the pattern form a consolidation phase where the price moves upward but without gaining significant momentum. These candles typically have small bodies, which indicate indecision or a lack of buying enthusiasm during the consolidation.

- Bearish Breakdown:

- After the consolidation phase (the three smaller candles), the final candle is a strong bearish candle that breaks below the low of the first large bullish candle. This suggests that the uptrend has exhausted itself, and the market is likely to turn down.

- Volume:

- Ideally, there should be higher volume during the first bullish candle and the final bearish candle. Higher volume on the final bearish candle increases the credibility of the pattern, as it indicates strong selling interest and a potential trend reversal.

How to Identify the Bearish Rising Three Methods:

- Initial Bullish Candle: The pattern begins with a strong bullish (green/white) candle that continues the uptrend.

- Three Small Candles: After the first bullish candle, three small bullish candles form within the range of the first candle. These candles should not exceed the high of the first candle, indicating that the bulls are losing their momentum but are still controlling the market.

- Final Bearish Candle: The final candle is a strong bearish (red/black) candle that closes below the low of the first bullish candle, indicating that the bears are taking control and the uptrend has likely ended.

Interpretation:

- Bearish Continuation: Although the pattern forms during an uptrend, it indicates that the uptrend is likely to reverse or experience a pullback. The final bearish candle suggests that the bulls have exhausted their strength, and the bears are now taking control of the market.

- Indecision and Exhaustion: The small-bodied candles in the middle of the pattern indicate a period of indecision or consolidation. The strong bearish candle that follows indicates that this period of indecision has ended and the market is ready to reverse or experience further downward movement.

How to Use the Rising Three Methods (Bearish) in Trading:

- Wait for Confirmation:

- Like most candlestick patterns, it is essential to wait for confirmation before acting on the Rising Three Methods (Bearish) pattern. This can come in the form of a close below the low of the first bullish candle or additional bearish candles after the final bearish candle.

- Confirmation could also include a break of support levels or a key trendline to indicate that the price is truly reversing.

- Volume:

- Volume analysis is crucial for the Rising Three Methods pattern. The final bearish candle should ideally have higher volume, signaling that the sellers are in control and that the trend is likely to continue down.

- The middle candles (small bullish candles) usually have lower volume, reflecting the consolidation phase.

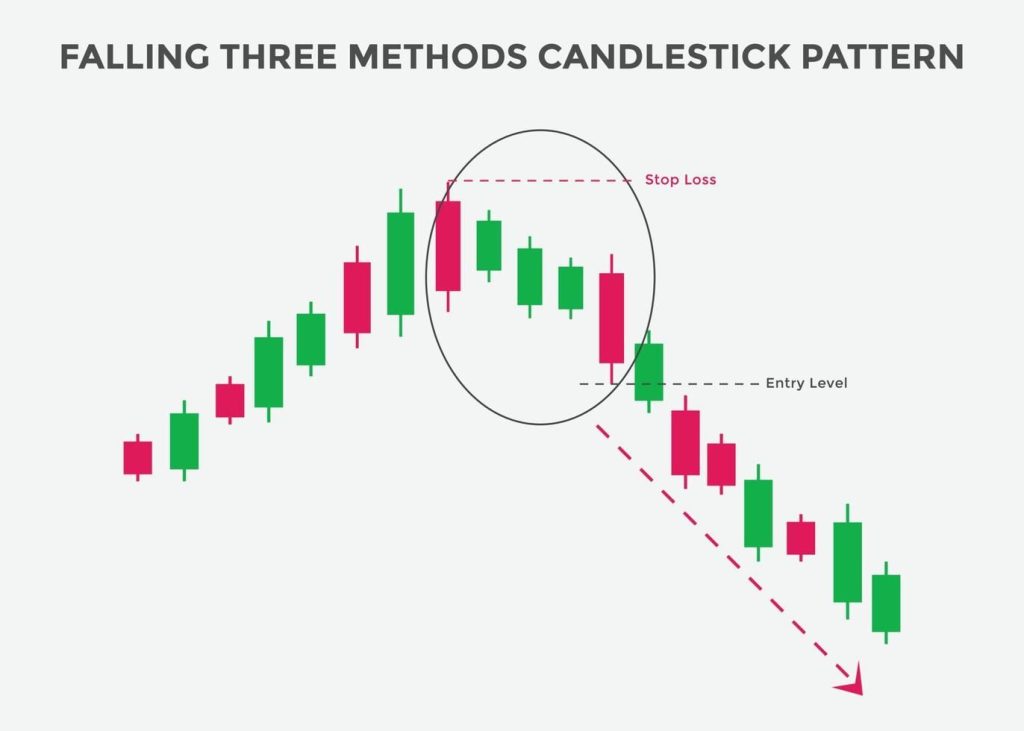

- Stop-Loss Placement:

- If entering a short position based on the pattern, the stop-loss can be placed just above the high of the first bullish candle or above the highest point reached by the three small bullish candles. This ensures that if the price continues higher, the position will be exited.

- Support and Resistance:

- Look for the pattern to form at or near resistance levels (e.g., a previous price high, trendline, or moving average). The pattern is more reliable when it forms near resistance, as it suggests that the uptrend is facing difficulty in moving higher.

Example of the Bearish Rising Three Methods in Context:

- Uptrend: The price has been rising steadily for several weeks, showing strong bullish momentum.

- First Bullish Candle: The first candle is a large bullish (green or white) candle that closes near its high, continuing the uptrend.

- Three Small Bullish Candles: The next three days show small bullish candles that form within the range of the first candle. The market is consolidating during this phase, with the price moving higher but without significant progress.

- Final Bearish Candle: On the fifth day, a large bearish (red or black) candle forms that closes below the low of the first bullish candle, signaling that the bears are taking control and a reversal is likely to follow.

Differences Between the Rising Three Methods (Bearish) and Other Patterns:

- Rising Three Methods vs. Rising Three Methods (Bullish):

- The Rising Three Methods (Bullish) pattern forms after a downtrend and consists of a large bearish candle followed by three small bullish candles, with the final candle being a large bullish candle. It signals a continuation of the uptrend.

- In contrast, the Bearish Rising Three Methods forms after an uptrend and signals a potential reversal or continuation of the downtrend.

- Rising Three Methods (Bearish) vs. Evening Star:

- The Evening Star is a three-candle bearish reversal pattern that forms after an uptrend, consisting of a long bullish candle, followed by a small-bodied candle (which can be bullish or bearish), and then a large bearish candle.

- While both patterns signal a bearish reversal, the Rising Three Methods (Bearish) consists of five candles with three small bullish candles in the middle, and the pattern is more about consolidation before a reversal. The Evening Star is a more immediate reversal pattern that forms over just three candles.

Important Notes:

- False Signals: The Rising Three Methods (Bearish) pattern can sometimes produce false signals, especially if the final bearish candle does not break the low of the first bullish candle decisively. It’s essential to confirm the reversal through additional indicators or price action.

- Market Conditions: The pattern is more reliable in trending markets or after a strong uptrend. If the market is already in a consolidation phase or has weak momentum, the pattern may not have the same significance.

- Time Frame: Like many continuation patterns, the Rising Three Methods (Bearish) is more reliable on higher time frames, such as daily or weekly charts, where trends are more established.

Summary:

The Rising Three Methods (Bearish) is a bearish continuation pattern that forms during an uptrend and signals a potential reversal or pullback. It consists of five candles: a long bullish candle, followed by three small bullish candles (consolidation), and a final long bearish candle that closes below the low of the first bullish candle. This pattern suggests that the market has exhausted its bullish momentum and that the bears may now take control. Traders should look for confirmation through a break of support, volume analysis, and additional bearish price action before acting on the signal.