A Bullish Marubozu is a strong bullish candlestick pattern that signals a decisive upward movement in the market. It is a single candlestick pattern characterized by a long body with no or very small wicks (shadows) at both the top and bottom of the candle. The lack of significant shadows indicates that the price moved steadily upward throughout the entire trading session, with the bulls maintaining control from the open to the close.

1. Characteristics of a Bullish Marubozu:

The Bullish Marubozu candlestick has the following key characteristics:

- Long Bullish Body:

- The body of the candlestick is long and typically filled with a solid color (green or white), indicating that the closing price is at or near the high of the session.

- No Upper Shadow (or very small):

- The upper shadow (wick) is either absent or extremely small. This suggests that the price reached its high and stayed there, showing that buying pressure was strong and there was no significant resistance during the session.

- No Lower Shadow (or very small):

- The lower shadow (wick) is also either absent or very small, indicating that there was little to no selling pressure during the session and that the price did not drop significantly after the open.

- Strong Closing Price:

- The candle closes at or near the highest price of the session, further reinforcing the idea that buyers controlled the market during the entire period.

2. How to Identify a Bullish Marubozu:

To identify a Bullish Marubozu, look for the following:

- Single Candle:

- The pattern is a single candlestick that forms after a downtrend or consolidation, indicating a strong reversal or continuation in an uptrend.

- Open and Close Price:

- The open price should be at or near the low of the candle, and the close price should be at or near the high of the candle.

- Minimal Shadows:

- The candlestick should have little to no upper or lower shadows. If there are shadows, they should be very small, and they should not exceed 10% of the body length.

- Strong Close:

- The close must be near the high of the session, demonstrating that the bulls were in control throughout the trading period.

3. Interpretation of the Bullish Marubozu:

The Bullish Marubozu suggests strong buying momentum and is interpreted as a bullish signal. Here’s why:

- Control by Bulls: The absence of shadows and the long body indicate that buyers maintained control throughout the entire session. This means that demand was strong enough to push the price up without any significant resistance from the sellers.

- Decisive Move Upward: The fact that the price opened at the low and closed near the high indicates a strong bullish sentiment. The market was dominated by buying pressure with little to no retracement.

- Trend Continuation or Reversal: If the Bullish Marubozu appears in the middle of a downtrend, it can signal a trend reversal, indicating that the bears are losing control and the bulls are taking over. If it appears during an uptrend, it suggests that the bullish momentum will continue.

4. How to Trade the Bullish Marubozu:

Entry:

- A buy position can be taken once the Bullish Marubozu completes and closes, especially if the price closes near its high and the overall market conditions are favorable for a bullish move.

- Some traders prefer to enter the market once the price moves above the high of the Bullish Marubozu to confirm that the trend is continuing.

Stop-Loss:

- A common stop-loss placement is below the low of the Bullish Marubozu candlestick. If the price retraces and drops below the low of the candlestick, it would indicate that the bullish momentum has failed.

- Another option is to place the stop-loss below the low of the prior candle (if it’s part of a larger pattern or trend), providing a bit more room for fluctuations.

Profit Target:

- Profit targets can be set using resistance levels such as previous highs, trendlines, or Fibonacci retracement levels.

- You could also use a risk-to-reward ratio (e.g., 2:1 or 3:1) to calculate a realistic exit point based on your stop-loss distance.

5. Confirmation and Additional Indicators:

Confirmation is Key:

- While the Bullish Marubozu is a strong candlestick on its own, it’s important to wait for confirmation from the market to reduce the risk of a false signal. Confirmation can come in the form of:

- Follow-up Bullish Candlestick:

- A strong bullish candlestick after the Bullish Marubozu (closing higher than the high of the Marubozu) is a good confirmation that the bullish trend is likely to continue.

- Volume:

- A high volume on the Bullish Marubozu adds strength to the signal. Strong buying volume indicates that the move is backed by substantial market participants, increasing the likelihood of the trend continuing.

- Momentum Indicators:

- RSI (Relative Strength Index): If the RSI is near oversold conditions (below 30) before the Bullish Marubozu forms and begins to rise afterward, it can confirm the upward momentum.

- MACD (Moving Average Convergence Divergence): A bullish crossover in the MACD or positive divergence can strengthen the signal.

- Moving Averages: If the price is breaking above a key moving average (such as the 50-day or 200-day moving average), it can provide additional confirmation of the trend reversal or continuation.

6. Example of the Bullish Marubozu Pattern:

Let’s say the price of a stock has been in a downtrend:

- Candle 1 (Bearish): The stock closes at $100, after opening at $105.

- Candle 2 (Bullish Marubozu): The stock opens at $98, forms a long green candle, and closes at $110. The entire body of the candlestick is green, with no significant shadows.

In this example, after the Bullish Marubozu closes, a trader could consider entering a long position at $110 or higher (the close of the Marubozu candle), with a stop-loss set just below $98 (the low of the candle). The trader may target the next resistance level as their profit target.

7. Limitations of the Bullish Marubozu:

While the Bullish Marubozu is a strong bullish signal, there are some limitations:

- False Signals:

- The Bullish Marubozu can sometimes produce false signals, especially in choppy or volatile markets. If the market shows weak follow-through after the pattern, the trend reversal may not be reliable.

- Requires Confirmation:

- As with any candlestick pattern, it’s essential to wait for confirmation, such as a follow-up bullish candle, an increase in volume, or positive momentum indicators. Without confirmation, the Bullish Marubozu might be an isolated price spike without sustained bullish momentum.

- Market Context:

- The Bullish Marubozu is most reliable when it forms after a downtrend or at the bottom of a correction, signaling a potential reversal. In an already established uptrend, the Bullish Marubozu may indicate continued strength, but it is less of a reversal signal and more of a continuation pattern.

8. Bullish Marubozu vs. Other Bullish Candlestick Patterns:

- Bullish Engulfing:

- The Bullish Engulfing pattern consists of two candlesticks: a small red (bearish) candle followed by a larger green (bullish) candle that engulfs the body of the first candle. While both patterns signal bullish reversal, the Bullish Marubozu is considered a more powerful signal because it shows that the bulls maintained control throughout the entire trading session.

- Morning Star:

- The Morning Star is a three-candle reversal pattern that typically forms after a downtrend. It consists of a long bearish candle, followed by a small-bodied candle (often a Doji), and then a long bullish candle. While the Morning Star suggests a reversal, the Bullish Marubozu is more forceful in its indication of sustained buying pressure.

- Three White Soldiers:

- The Three White Soldiers is a three-candle bullish reversal pattern that forms in a downtrend. It consists of three consecutive long bullish candles. While the Bullish Marubozu represents a single decisive move, the Three White Soldiers pattern indicates a sustained buildup of buying pressure over multiple sessions.

9. Key Takeaways:

- The Bullish Marubozu is a single candlestick pattern that indicates strong bullish momentum, with the price moving from the low to the high of the session without significant retracement.

- It is a bullish reversal pattern when it forms after a downtrend, or a bullish continuation pattern when it forms within an uptrend.

- A long body with little to no upper or lower shadows is

4o mini

You said:

Tweezer Bottom

ChatGPT said:

ChatGPT

Tweezer Bottom Candlestick Pattern

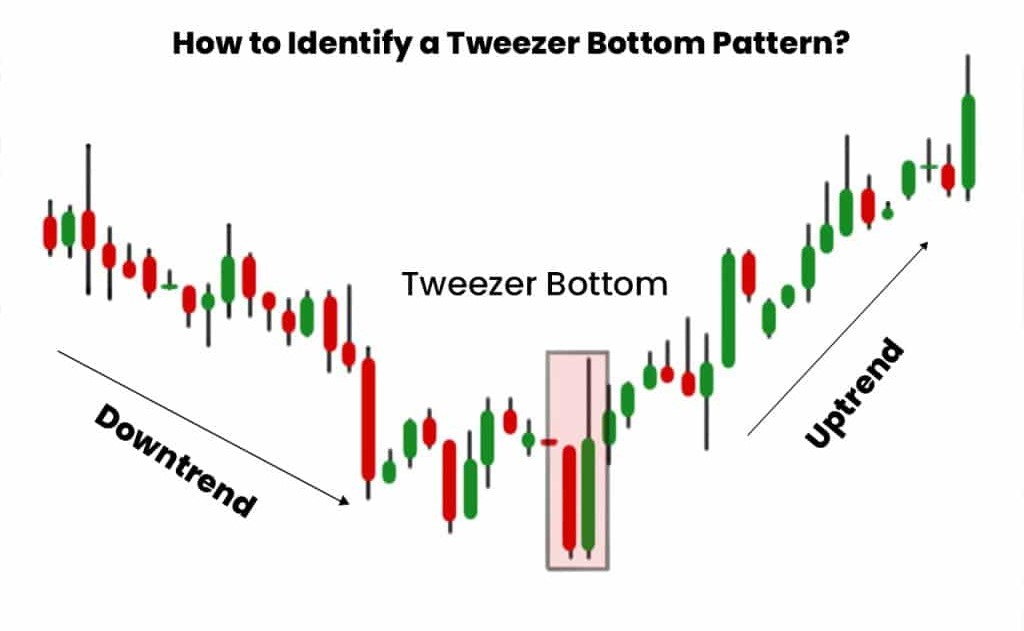

The Tweezer Bottom is a bullish reversal candlestick pattern that occurs at the end of a downtrend. It consists of two candlesticks with matching lows, indicating that selling pressure has diminished and that buyers are beginning to gain control of the market. This pattern signals that a reversal to the upside may be forthcoming, particularly when supported by other technical indicators or price action.

1. Characteristics of the Tweezer Bottom Pattern:

A Tweezer Bottom pattern has the following characteristics:

- Two Candlesticks:

- The pattern consists of two candlesticks, one bearish and one bullish.

- Matching Lows:

- The key feature of the Tweezer Bottom is that the low of the first candlestick (a bearish candle) and the low of the second candlestick (a bullish candle) are roughly equal or very close to each other.

- This indicates that the sellers were unable to push the price lower on the second day, which suggests that demand is starting to outweigh supply.

- First Candlestick (Bearish):

- The first candlestick is a long bearish (red/black) candle, which confirms the current downtrend and shows that the sellers are in control.

- Second Candlestick (Bullish):

- The second candlestick is a bullish (green/white) candle, which closes higher than the first candle. This indicates that the buyers are entering the market and that a reversal may be underway.

- Matching Lows:

- The lows of both candlesticks should be very close to each other. This is a key feature of the pattern and signals that the market reached a temporary bottom, where selling pressure is exhausted.

2. How to Identify the Tweezer Bottom Pattern:

To identify a Tweezer Bottom pattern, look for the following conditions:

- Trend Preceding the Pattern:

- The Tweezer Bottom pattern must form after a downtrend or during a bearish market. This is crucial, as the pattern signals a potential reversal from the downtrend to an uptrend.

- First Candlestick (Bearish):

- The first candle is a long bearish candle, indicating that sellers are in control and pushing the price down.

- Second Candlestick (Bullish):

- The second candlestick should be a bullish (green/white) candle, which opens and closes higher than the previous candle’s close, confirming that the buyers have taken control.

- Matching Lows:

- The lows of both candles should be nearly identical. The proximity of the lows is the key distinguishing feature of the Tweezer Bottom pattern. This shows that the market is finding support at a certain level, and the bears were unable to drive the price lower on the second day.

3. Interpretation of the Tweezer Bottom Pattern:

The Tweezer Bottom is interpreted as a bullish reversal signal, indicating that the market may be transitioning from a downtrend to an uptrend. Here’s why:

- Exhaustion of Sellers: The first bearish candlestick suggests that sellers have been in control, but the fact that the second candlestick has a matching low indicates that the selling pressure has diminished. The buyers are starting to step in, and the market may have found a temporary bottom.

- Potential for Reversal: The second candlestick, which is bullish, confirms that buyers are taking control, and the market may be starting to reverse. The equal lows indicate that the market has tested the selling pressure, but now the buyers are in a better position to drive the price higher.

- Market Sentiment Shift: The pattern shows that the bearish momentum is losing steam and that a shift in sentiment is occurring, with bulls gaining control. This suggests the possibility of a trend reversal to the upside.

4. How to Trade the Tweezer Bottom Pattern:

Entry:

- A common strategy is to enter a long position after the second candlestick closes, especially if the candle closes strongly (near its high). This shows that the reversal is likely to be sustained.

- Some traders prefer to wait for confirmation in the form of a break above the high of the second candlestick. This can give further confidence that the bullish reversal is taking place.

Stop-Loss:

- A stop-loss can be placed just below the low of the second candlestick, as this would indicate that the market may not be reversing and the bearish trend could continue.

- Another option is to place the stop-loss below the low of the first candlestick, if you want to give the market more room to fluctuate.

Profit Target:

- Profit targets can be set at nearby resistance levels, such as previous highs, trendlines, or Fibonacci retracement levels.

- Alternatively, you can use a risk-to-reward ratio (e.g., 2:1 or 3:1) to determine your exit point based on the stop-loss distance.

5. Confirmation and Additional Indicators:

While the Tweezer Bottom is a strong reversal signal, confirmation is essential for increasing the likelihood of a successful trade:

- Follow-up Bullish Candlestick:

- A strong bullish confirmation candle after the Tweezer Bottom adds credibility to the pattern. This could be a large green candle or a gap-up opening that confirms the strength of the reversal.

- Volume:

- Increased volume on the second candlestick is a good sign that the bullish reversal is backed by significant market participation. If volume is higher on the second day compared to the first, it suggests that buyers are entering the market with strength.

- Momentum Indicators:

- RSI (Relative Strength Index): If the RSI was in oversold territory (below 30) before the Tweezer Bottom and begins to rise afterward, it confirms the potential for an upward reversal.

- MACD (Moving Average Convergence Divergence): A bullish MACD crossover after the Tweezer Bottom can strengthen the signal.

- Moving Averages: If the price is approaching or breaking above a key moving average (e.g., the 50-day or 200-day MA), it can add further confirmation that the reversal is likely.

6. Example of the Tweezer Bottom Pattern:

Let’s say the price of a stock has been in a downtrend:

- Candle 1 (Bearish): The stock closes at $50, after opening at $55.

- Candle 2 (Bullish): The stock opens at $50, forms a long green candle, and closes at $55. The low of the second candle is at $50, matching the low of the first candle.

In this case, a trader may consider entering a long position after the second candle closes at $55, especially if it’s accompanied by a strong volume increase or a follow-up bullish candle. The stop-loss could be placed just below the low of the second candlestick ($50), with a profit target based on resistance levels.

7. Limitations of the Tweezer Bottom Pattern:

While the Tweezer Bottom can be a strong reversal signal, there are some limitations:

- False Signals:

- The pattern can sometimes produce false signals, especially in volatile markets or during periods of consolidation. It’s important to wait for confirmation, such as a follow-up bullish candle or an increase in volume, before entering a trade.

- Market Context:

- The Tweezer Bottom is most reliable when it forms after a significant downtrend. In a sideways market or during periods of indecision, the pattern may not be as effective.

- Lack of Follow-through:

- If the market does not follow through with strong bullish price action after the Tweezer Bottom, the pattern may fail, and the price could continue to move lower.

8. Tweezer Bottom vs. Tweezer Top:

- The Tweezer Bottom is a bullish reversal pattern that occurs at the end of a downtrend and indicates that buying pressure may be starting to outweigh selling pressure. It consists of two candlesticks with matching lows.

- The Tweezer Top is a bearish reversal pattern that occurs at the end of an uptrend and suggests that selling pressure may be increasing. It also consists of two candlesticks, but the highs of the candles match, and the second candle is typically a bearish one.

Both patterns share the characteristic of having matching highs or lows, but they signal opposite market conditions: one signals a reversal to the upside, and the other signals a reversal to the downside.

9. Key Takeaways:

- The Tweezer Bottom is a bullish reversal pattern that occurs after a downtrend, signaling that the market may be finding support and shifting toward an uptrend.

- The pattern consists of two candlesticks with matching lows, with the first being bearish and the second being bullish.

- Confirmation through additional price action (like a follow-up bullish candle) and increased volume enhances the reliability of the signal.

- Traders can enter a long position after the second candlestick closes, with a stop-loss placed below the low of the second candlestick.

- The Tweezer Bottom is most effective when it forms after a strong downtrend and when confirmed by other technical indicators.